- Home

- News

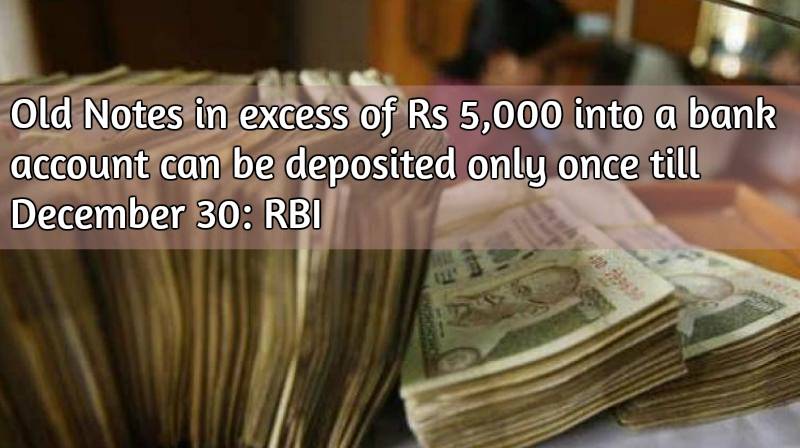

- Old Notes in excess of Rs 5,000 into a bank account can be deposited only once till December 30: RBI

Old Notes in excess of Rs 5,000 into a bank account can be deposited only once till December 30: RBI

To check the laundering of unaccounted for cash through bank accounts, the RBI on Monday said that deposits totalling more than Rs 5,000 in old Rs 500 and Rs 1,000 notes can be made only once per account until December 30.

However, there is no limit on the value of deposits of new bank notes — also called specified bank notes — under the Taxation & Investment Regime for Pradhan Mantri Garib Kalyan Yojana (PMGKY) 2016.

If someone has more than Rs 5,000 in old notes, a deposit will only is allowed after the depositor satisfactorily answers why they couldn't put the money into their account earlier.

6 things you need to know about depositing old notes in banks

1) Deposits more than Rs 5,000 in old notes allowed just once per account until December 30, 2016.

2) Deposits of over Rs 5,000 will be afforded only questioning By 2 bank officials. The questioning of depositor will be made on record and an audit trail will be created for a 'later stage'. A satisfactory explanation on the deposit made would be 'needed'.

3) Even when notes smaller than Rs 5000 are made in an account and such notes taken together on cumulative basis exceed Rs 5,000 they may be subject to scrutiny.

4) No more notes can be deposited after December 30.

5) Full value of notes in excess of Rs 5,000 shall be credited to only KYC compliant accounts and if the accounts are not KYC compliant credits may be restricted up to Rs 50,000 subject to the conditions governing the conduct of such accounts.

6) The curbs are not applicable to notes for the purpose of deposits under the Taxation and Investment Regime for the Pradhan Mantri Garib Kalyan Yojana, 2016.

Upto 12% Cashback

Upto 12% Cashback Upto 12% Cashback

Upto 12% Cashback Upto ₹200 Cashback

Upto ₹200 Cashback Upto 10.5% Cashback

Upto 10.5% Cashback Upto 10% Cashback

Upto 10% Cashback Upto ₹280 Cashback

Upto ₹280 Cashback Upto 8.5% Cashback

Upto 8.5% Cashback Upto ₹25 Cashback

Upto ₹25 Cashback Upto 0.7% Cashback

Upto 0.7% Cashback Upto ₹40 Cashback

Upto ₹40 Cashback Upto 13.5% Cashback

Upto 13.5% Cashback Upto 21% Cashback

Upto 21% Cashback Upto 35% Cashback

Upto 35% Cashback Upto 10.2% Cashback

Upto 10.2% Cashback Upto ₹1520 Cashback

Upto ₹1520 Cashback Upto 20% Cashback

Upto 20% Cashback Upto ₹30 Cashback

Upto ₹30 Cashback Upto 17.36% Cashback

Upto 17.36% Cashback Upto ₹111.86 Cashback

Upto ₹111.86 Cashback Upto 8.5% Cashback

Upto 8.5% Cashback Upto 7.7% Cashback

Upto 7.7% Cashback Upto 6.80% Cashback

Upto 6.80% Cashback Upto ₹100 Cashback

Upto ₹100 Cashback Upto ₹190 Cashback

Upto ₹190 Cashback Upto 6.7% Cashback

Upto 6.7% Cashback Upto 7.2% Cashback

Upto 7.2% Cashback Upto 9% Cashback

Upto 9% Cashback Upto ₹7 Cashback

Upto ₹7 Cashback Upto ₹1000 Cashback

Upto ₹1000 Cashback Upto ₹60 Cashback

Upto ₹60 Cashback Upto 8% Cashback

Upto 8% Cashback Upto ₹150 Cashback

Upto ₹150 Cashback Upto ₹9 Cashback

Upto ₹9 Cashback Upto 9% Cashback

Upto 9% Cashback Upto 4.25% Cashback

Upto 4.25% Cashback Upto ₹160 Cashback

Upto ₹160 Cashback Upto 1.70% Cashback

Upto 1.70% Cashback Upto 7% Cashback

Upto 7% Cashback Upto 5.4% Cashback

Upto 5.4% Cashback Upto 18% Cashback

Upto 18% Cashback Upto 15% Cashback

Upto 15% Cashback Upto 15% Cashback

Upto 15% Cashback Upto 15% Cashback

Upto 15% Cashback Upto 15% Cashback

Upto 15% Cashback Upto 15% Cashback

Upto 15% Cashback Upto 15% Cashback

Upto 15% Cashback Upto 15% Cashback

Upto 15% Cashback Upto 7% Cashback

Upto 7% Cashback Upto 8.5% Cashback

Upto 8.5% Cashback Upto 20% Cashback

Upto 20% Cashback Upto 15% Cashback

Upto 15% Cashback Upto 1.2% Cashback

Upto 1.2% Cashback Upto 3.15% Cashback

Upto 3.15% Cashback Upto ₹180 Cashback

Upto ₹180 Cashback Upto 12% Cashback

Upto 12% Cashback Upto 8.5% Cashback

Upto 8.5% Cashback Upto 3.50% Cashback

Upto 3.50% Cashback Upto 2.56% Cashback

Upto 2.56% Cashback Upto 17% Cashback

Upto 17% Cashback Upto 4.30% Cashback

Upto 4.30% Cashback Upto ₹59.5 Cashback

Upto ₹59.5 Cashback Upto ₹450 Cashback

Upto ₹450 Cashback Upto 9% Cashback

Upto 9% Cashback Upto 7% Cashback

Upto 7% Cashback Upto 5.71% Cashback

Upto 5.71% Cashback Upto 13% Cashback

Upto 13% Cashback Upto ₹1500 Cashback

Upto ₹1500 Cashback Upto ₹25 Cashback

Upto ₹25 Cashback Upto 13.09% Cashback

Upto 13.09% Cashback Upto 10% Cashback

Upto 10% Cashback Upto ₹4 Cashback

Upto ₹4 Cashback Upto 4% Cashback

Upto 4% Cashback Upto ₹550 Cashback

Upto ₹550 Cashback Upto ₹2400 Cashback

Upto ₹2400 Cashback Upto ₹212 Cashback

Upto ₹212 Cashback Upto ₹190 Cashback

Upto ₹190 Cashback Upto ₹375 Cashback

Upto ₹375 Cashback Upto ₹280 Cashback

Upto ₹280 Cashback Upto ₹25 Cashback

Upto ₹25 Cashback Upto 8% Cashback

Upto 8% Cashback Upto 25% Cashback

Upto 25% Cashback Upto 7.2% Cashback

Upto 7.2% Cashback Upto 1.6% Cashback

Upto 1.6% Cashback Upto ₹100 Cashback

Upto ₹100 Cashback Upto ₹9 Cashback

Upto ₹9 Cashback Upto 14% Cashback

Upto 14% Cashback Upto ₹32 Cashback

Upto ₹32 Cashback Upto 18% Cashback

Upto 18% Cashback Upto ₹300 Cashback

Upto ₹300 Cashback Upto 13% Cashback

Upto 13% Cashback Upto 5% Cashback

Upto 5% Cashback Upto ₹180 Cashback

Upto ₹180 Cashback Upto ₹1400 Cashback

Upto ₹1400 Cashback Upto 16% Cashback

Upto 16% Cashback Upto 2.55% Cashback

Upto 2.55% Cashback Upto ₹850 Cashback

Upto ₹850 Cashback Upto 14% Cashback

Upto 14% Cashback Upto 18% Cashback

Upto 18% Cashback Upto ₹108 Cashback

Upto ₹108 Cashback Upto 5% Cashback

Upto 5% Cashback Upto 17% Cashback

Upto 17% Cashback Upto ₹10350 Cashback

Upto ₹10350 Cashback Upto 8.5% Cashback

Upto 8.5% Cashback Upto ₹400 Cashback

Upto ₹400 Cashback Upto 22% Cashback

Upto 22% Cashback Upto 18% Cashback

Upto 18% Cashback Upto 12% Cashback

Upto 12% Cashback Upto ₹180 Cashback

Upto ₹180 Cashback Upto ₹1700 Cashback

Upto ₹1700 Cashback Upto ₹2800 Cashback

Upto ₹2800 Cashback Upto 21.25% Cashback

Upto 21.25% Cashback Upto 21% Cashback

Upto 21% Cashback Upto 4.9% Cashback

Upto 4.9% Cashback Upto ₹600 Cashback

Upto ₹600 Cashback Upto ₹100 Cashback

Upto ₹100 Cashback Upto 2.10% Cashback

Upto 2.10% Cashback Upto 9% Cashback

Upto 9% Cashback Upto ₹245 Cashback

Upto ₹245 Cashback Upto 18% Cashback

Upto 18% Cashback Upto 19% Cashback

Upto 19% Cashback Upto 35% Cashback

Upto 35% Cashback Upto ₹20 Cashback

Upto ₹20 Cashback Upto 12% Cashback

Upto 12% Cashback Upto 5% Cashback

Upto 5% Cashback Upto 15% Cashback

Upto 15% Cashback Upto 58% Cashback

Upto 58% Cashback Upto 10% Cashback

Upto 10% Cashback Upto 30% Cashback

Upto 30% Cashback Upto 46.8% Cashback

Upto 46.8% Cashback Upto ₹3600 Cashback

Upto ₹3600 Cashback Upto ₹250 Cashback

Upto ₹250 Cashback Upto 18% Cashback

Upto 18% Cashback Upto ₹2415 Cashback

Upto ₹2415 Cashback Upto ₹2500 Cashback

Upto ₹2500 Cashback Upto 12% Cashback

Upto 12% Cashback Upto 20% Cashback

Upto 20% Cashback Upto 50% Cashback

Upto 50% Cashback Upto 21.25% Cashback

Upto 21.25% Cashback Upto 8.5% Cashback

Upto 8.5% Cashback Upto 25% Cashback

Upto 25% Cashback Upto 13% Cashback

Upto 13% Cashback Upto 6.8% Cashback

Upto 6.8% Cashback Upto 8% Cashback

Upto 8% Cashback Upto ₹500 Cashback

Upto ₹500 Cashback Upto 2.8% Cashback

Upto 2.8% Cashback Upto ₹6900 Cashback

Upto ₹6900 Cashback Upto ₹100 Cashback

Upto ₹100 Cashback Upto 21.25% Cashback

Upto 21.25% Cashback Upto 14% Cashback

Upto 14% Cashback Upto 20% Cashback

Upto 20% Cashback Upto 60% Cashback

Upto 60% Cashback Upto 15% Cashback

Upto 15% Cashback Upto ₹1100 Cashback

Upto ₹1100 Cashback Upto ₹350 Cashback

Upto ₹350 Cashback Upto ₹1200 Cashback

Upto ₹1200 Cashback Upto 32% Cashback

Upto 32% Cashback Upto 20% Cashback

Upto 20% Cashback Upto 16% Cashback

Upto 16% Cashback Upto ₹30 Cashback

Upto ₹30 Cashback Upto 8.5% Cashback

Upto 8.5% Cashback Upto ₹400 Cashback

Upto ₹400 Cashback Upto 24% Cashback

Upto 24% Cashback Upto ₹500 Cashback

Upto ₹500 Cashback Upto 13.89% Cashback

Upto 13.89% Cashback Upto 10.62% Cashback

Upto 10.62% Cashback Upto 6.3% Cashback

Upto 6.3% Cashback Upto 22.5% Cashback

Upto 22.5% Cashback Upto 10% Cashback

Upto 10% Cashback Upto 12.75% Cashback

Upto 12.75% Cashback Upto 1.7% Cashback

Upto 1.7% Cashback Upto 25% Cashback

Upto 25% Cashback Upto 26% Cashback

Upto 26% Cashback Upto 40% Cashback

Upto 40% Cashback Upto 1.5% Cashback

Upto 1.5% Cashback Upto 65% Cashback

Upto 65% Cashback Upto 18.70% Cashback

Upto 18.70% Cashback Upto 9% Cashback

Upto 9% Cashback Upto 6.5% Cashback

Upto 6.5% Cashback Upto 7% Cashback

Upto 7% Cashback Upto 16% Cashback

Upto 16% Cashback Upto 17% Cashback

Upto 17% Cashback Upto ₹10440 Cashback

Upto ₹10440 Cashback Upto 20% Cashback

Upto 20% Cashback Upto 24.5% Cashback

Upto 24.5% Cashback Upto 21% Cashback

Upto 21% Cashback Upto 16% Cashback

Upto 16% Cashback Upto 4% Cashback

Upto 4% Cashback Upto 100% Cashback

Upto 100% Cashback Upto ₹102 Cashback

Upto ₹102 Cashback Upto 8% Cashback

Upto 8% Cashback Upto 12% Cashback

Upto 12% Cashback Upto 4% Cashback

Upto 4% Cashback Upto 10.5% Cashback

Upto 10.5% Cashback Upto 8.5% Cashback

Upto 8.5% Cashback Upto 8.5% Cashback

Upto 8.5% Cashback Upto 4.9% Cashback

Upto 4.9% Cashback Upto 4.5% Cashback

Upto 4.5% Cashback Upto 12.75% Cashback

Upto 12.75% Cashback Upto 51% Cashback

Upto 51% Cashback Upto 8.5% Cashback

Upto 8.5% Cashback Upto 10% Cashback

Upto 10% Cashback Upto ₹5 Cashback

Upto ₹5 Cashback Upto 22% Cashback

Upto 22% Cashback Upto 24% Cashback

Upto 24% Cashback Upto 11% Cashback

Upto 11% Cashback Upto 15% Cashback

Upto 15% Cashback Upto 25% Cashback

Upto 25% Cashback Upto ₹2300 Cashback

Upto ₹2300 Cashback Upto ₹1000 Cashback

Upto ₹1000 Cashback Upto ₹2400 Cashback

Upto ₹2400 Cashback Upto 9% Cashback

Upto 9% Cashback Upto 4% Cashback

Upto 4% Cashback Upto 20% Cashback

Upto 20% Cashback Upto 18% Cashback

Upto 18% Cashback Upto 5.5% Cashback

Upto 5.5% Cashback Upto 10% Cashback

Upto 10% Cashback Upto 6.8% Cashback

Upto 6.8% Cashback Upto 17% Cashback

Upto 17% Cashback Upto ₹1500 Cashback

Upto ₹1500 Cashback Upto 8% Cashback

Upto 8% Cashback Upto ₹350 Cashback

Upto ₹350 Cashback Upto 30% Cashback

Upto 30% Cashback Upto 12% Cashback

Upto 12% Cashback Upto 10.5% Cashback

Upto 10.5% Cashback Upto 45% Cashback

Upto 45% Cashback Upto 10.2% Cashback

Upto 10.2% Cashback Upto ₹250 Cashback

Upto ₹250 Cashback Upto ₹300 Cashback

Upto ₹300 Cashback Upto 17% Cashback

Upto 17% Cashback Upto ₹35 Cashback

Upto ₹35 Cashback Upto ₹3500 Cashback

Upto ₹3500 Cashback Upto 13.50% Cashback

Upto 13.50% Cashback Upto 13% Cashback

Upto 13% Cashback Upto 14.5% Cashback

Upto 14.5% Cashback Upto 15% Cashback

Upto 15% Cashback Upto 100 Cashback

Upto 100 Cashback Upto ₹650 Cashback

Upto ₹650 Cashback Upto 80% Cashback

Upto 80% Cashback Upto 50% Cashback

Upto 50% Cashback Upto ₹2300 Cashback

Upto ₹2300 Cashback Upto 12% Cashback

Upto 12% Cashback Upto 6.31% Cashback

Upto 6.31% Cashback Upto 17.5% Cashback

Upto 17.5% Cashback Upto ₹2300 Cashback

Upto ₹2300 Cashback Upto 8.5% Cashback

Upto 8.5% Cashback Upto 14% Cashback

Upto 14% Cashback Upto ₹800 Cashback

Upto ₹800 Cashback Upto 5.95% Cashback

Upto 5.95% Cashback Upto ₹600 Cashback

Upto ₹600 Cashback Upto ₹315 Cashback

Upto ₹315 Cashback Upto ₹2800 Cashback

Upto ₹2800 Cashback Upto 8.5% Cashback

Upto 8.5% Cashback Upto 8.5% Cashback

Upto 8.5% Cashback Upto 23.11% Cashback

Upto 23.11% Cashback Upto 5% Cashback

Upto 5% Cashback Upto 10% Cashback

Upto 10% Cashback Upto ₹500 Cashback

Upto ₹500 Cashback Upto 10% Cashback

Upto 10% Cashback Upto 74.4% Cashback

Upto 74.4% Cashback Upto ₹300 Cashback

Upto ₹300 Cashback Upto 10% Cashback

Upto 10% Cashback Upto 25% Cashback

Upto 25% Cashback Upto 21.25% Cashback

Upto 21.25% Cashback Upto 13.5% Cashback

Upto 13.5% Cashback Upto 18% Cashback

Upto 18% Cashback Upto 10% Cashback

Upto 10% Cashback Upto 22% Cashback

Upto 22% Cashback Upto 25% Cashback

Upto 25% Cashback Upto 8% Cashback

Upto 8% Cashback Upto 3.2% Cashback

Upto 3.2% Cashback Upto ₹250 Cashback

Upto ₹250 Cashback Upto ₹320 Cashback

Upto ₹320 Cashback Upto ₹25 Cashback

Upto ₹25 Cashback Upto 23% Cashback

Upto 23% Cashback Upto 16% Cashback

Upto 16% Cashback Upto 10% Cashback

Upto 10% Cashback Upto 70% Cashback

Upto 70% Cashback Upto 21% Cashback

Upto 21% Cashback Upto ₹56000 Cashback

Upto ₹56000 Cashback Upto ₹2656.06 Cashback

Upto ₹2656.06 Cashback Upto 25% Cashback

Upto 25% Cashback Upto 12.75% Cashback

Upto 12.75% Cashback Upto 67.5% Cashback

Upto 67.5% Cashback Upto 4% Cashback

Upto 4% Cashback Upto 75% Cashback

Upto 75% Cashback Upto 70% Cashback

Upto 70% Cashback Upto ₹180 Cashback

Upto ₹180 Cashback Upto 80% Cashback

Upto 80% Cashback Upto 15% Cashback

Upto 15% Cashback Upto ₹18 Cashback

Upto ₹18 Cashback Upto ₹50 Cashback

Upto ₹50 Cashback Upto 12% Cashback

Upto 12% Cashback Upto 22% Cashback

Upto 22% Cashback Upto 15% Cashback

Upto 15% Cashback Upto ₹240 Cashback

Upto ₹240 Cashback Upto 17.5% Cashback

Upto 17.5% Cashback Upto ₹63 Cashback

Upto ₹63 Cashback Upto 59.4% Cashback

Upto 59.4% Cashback Upto 16% Cashback

Upto 16% Cashback Upto 32% Cashback

Upto 32% Cashback Upto 30% Cashback

Upto 30% Cashback Upto 48% Cashback

Upto 48% Cashback Upto 7% Cashback

Upto 7% Cashback Upto 35% Cashback

Upto 35% Cashback Upto 10% Cashback

Upto 10% Cashback Upto 32% Cashback

Upto 32% Cashback